Dealing with financial challenges can be overwhelming, but taking timely action can help you regain financial stability. Understanding how to use credit and mortgages financial tools is essential for avoiding money problems and effectively managing your finances. Having a clear understanding of how credit and mortgages work is crucial.

By using these tools wisely, you can prevent financial difficulties and maintain control over your finances. Properly managing your finances can lead to long-term financial stability and success.

Set Your Budget

Creating a budget is a powerful way to manage your finances. It helps you pay for important things, save for the future, and handle unexpected costs.

Budgeting Tools and Tips

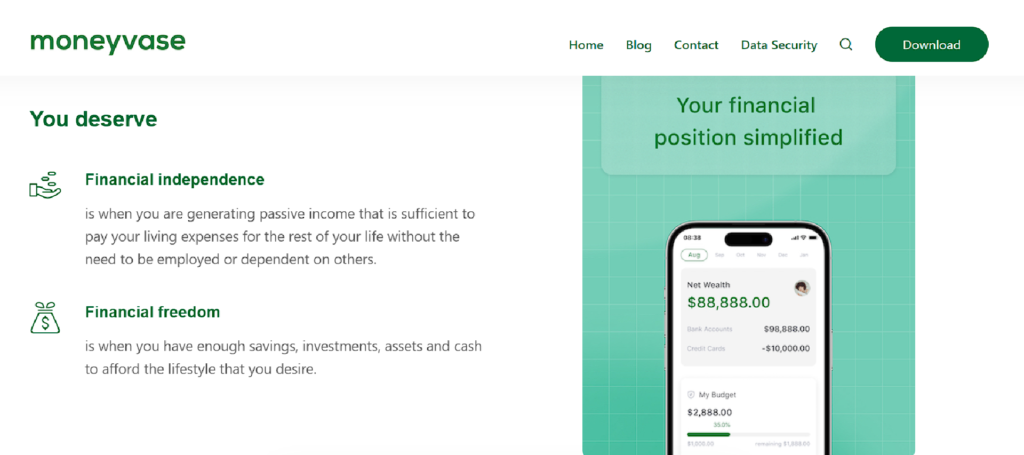

Free budgeting apps, like the moneyvase app, can help you create and stick to a budget. moneyvase is user-friendly, offering features like income and expense tracking, financial goal setting, and spending alerts. By using moneyvase, you can better control your finances and work towards long-term stability.

Sell Unneeded Items

Consider selling items you no longer need or swapping for cheaper alternatives. Be cautious when selling assets that are still under finance, like a car loan.

Reduce Expenses

Limit discretionary spending, such as dining out or gym memberships. Look for ways to spend less money on everyday things. Buy things in large quantities or bring your own cup to coffee shops for cheaper prices. These small savings can accumulate over time.

Switch providers for services like banking, insurance, phone, internet, or electricity to make sure you are getting the best deal. Review your contracts regularly to avoid paying for unnecessary services.

Earn Additional Income

Consider taking on additional work or overtime. Explore opportunities in ride-sharing, child-minding, or hospitality.

Set a Savings Goal

After budgeting, set a specific savings goal. Establishing a goal makes it more likely you will achieve it. Consider setting aside money for emergencies to cover unexpected expenses.

Managing a Financial Crisis

Build an Emergency Fund, An emergency fund is essential for covering urgent, unexpected expenses. If you are struggling, communicate with your creditors to negotiate manageable payment plans. Many lenders have hardship departments to assist you.

Things to Watch Out For

Loan Details: Understand the terms of any loan you consider, including minimum repayments, loan duration, and total interest. Defaulting on loans can negatively impact your credit report.

Payday Loans: These short-term loans often come with high interest rates and penalty fees. Consider these options carefully, as missing repayments can quickly escalate costs.

Rent-to-Buy or Product Rentals: While renting household appliances may seem attractive, it often costs more in the long run. Carefully evaluate these options to ensure they fit within your budget.

Interest-Free Deals: Retailers may offer interest-free financing, but be wary of high-interest rates and fees once the interest-free period ends. Understand the full cost before committing. This is one of the no and low-interest loan schemes company in Australia.

Buy Now, Pay Later Services: These services allow installment payments but may include hidden costs and fees. They can lead to taking on more debt than you can afford. Research thoroughly to understand all terms and conditions.

By understanding these financial tools and strategies, you can better manage your money, save more, and achieve financial security.