A good credit score can open doors to numerous financial opportunities, while a poor one can act as a barrier. Understanding how credit scores work in Australia is essential for anyone looking to maintain financial health and access credit products such as loans, credit cards, or mortgages.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness. In Australia, this score ranges between 0 and 1200, depending on the credit reporting agency. It is based on the information contained in your credit report, which includes your credit history, the types of credit you have used, and your repayment behavior.

How is a Credit Score Calculated?

Credit scores in Australia are calculated by major credit reporting agencies such as Equifax, Experian, and illion. While the exact algorithms are proprietary, several common factors influence your credit score:

- Repayment History: Timely repayments of credit accounts positively impact your score. Late payments, defaults, or bankruptcy records can significantly lower your score.

- Credit Utilization: This is the ratio of your current credit card balances to your credit limits. Lower utilization indicates better financial management.

- Credit Applications: Frequent applications for credit can be seen as a red flag, suggesting financial distress.

- Credit Mix: Having a variety of credit accounts (e.g., credit cards, loans, mortgages) can positively influence your score if managed well.

- Length of Credit History: A longer credit history can provide a clearer picture of your financial behavior.

Why is Your Credit Score Important?

Your credit score affects your ability to borrow money and the terms of that borrowing. Lenders use credit scores to assess the risk of lending to you. A higher score can lead to better loan terms, including lower interest rates and higher credit limits. Conversely, a lower score may result in higher interest rates or outright rejection of credit applications.

How to Check Your Credit Score

In Australia, you are entitled to a free copy of your credit report once a year from each of the major credit reporting agencies. If you are wondering, how to check my credit score, you can visit the websites of agencies like Equifax, Experian, or illion. Regularly checking your credit report helps you stay informed about your financial standing and identify any errors or fraudulent activities early.

What is a Good Credit Score?

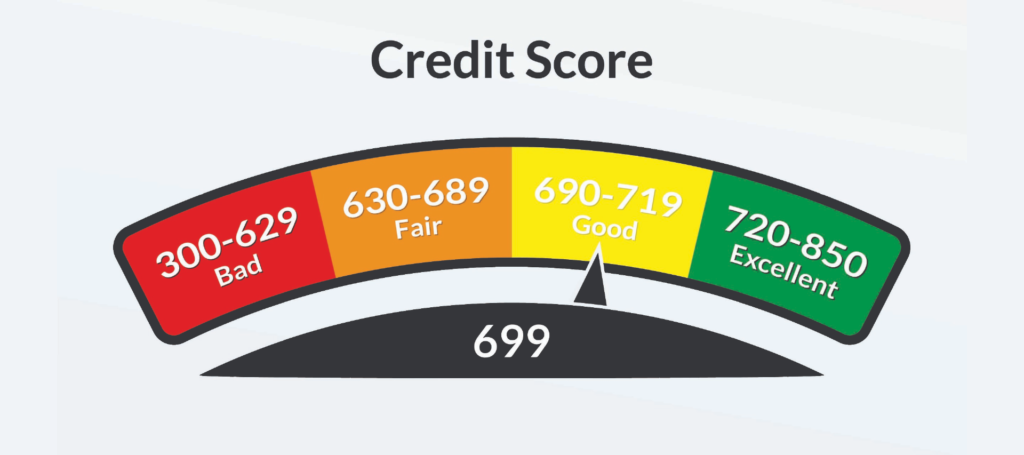

A good credit score in Australia typically falls between 622 and 1200. Scores are usually classified as follows:

- Excellent (833-1200): You are highly likely to be approved for credit and receive the best interest rates.

- Very Good (726-832): You have a good chance of approval and access to competitive rates.

- Good (622-725): You are likely to be approved for most credit products.

- Average (510-621): You may be approved but could face higher interest rates.

- Below Average (0-509): You may struggle to get approved and face high interest rates.

How to Improve Your Credit Score

If your credit score is not where you would like it to be, there are several steps you can take to improve it:

- Pay Bills on Time: Ensure all your bills and loan repayments are made on time.

- Reduce Debt: Aim to pay down existing debt rather than accumulating more.

- Limit Credit Applications: Apply for new credit only when necessary.

- Check Your Credit Report: Regularly review your credit report for errors and dispute any inaccuracies.

- Use Credit Wisely: Keep your credit card balances low and within manageable limits.

The Role of Comprehensive Credit Reporting (CCR)

Australia has adopted Comprehensive Credit Reporting (CCR), which means that both positive and negative credit information is included in your credit report. This system provides a more complete picture of your credit behavior. Positive credit behaviors, such as making timely payments and managing debt well, are recorded and can help improve your credit score over time.

Conclusion

Understanding and maintaining a good credit score is crucial for financial health and access to credit in Australia. By staying informed about the factors that influence your credit score and taking steps to manage your credit responsibly, you can enhance your creditworthiness and secure better financial opportunities. Remember to regularly check your credit score, know what is a good credit score, and learn how to improve your credit score to stay financially healthy.